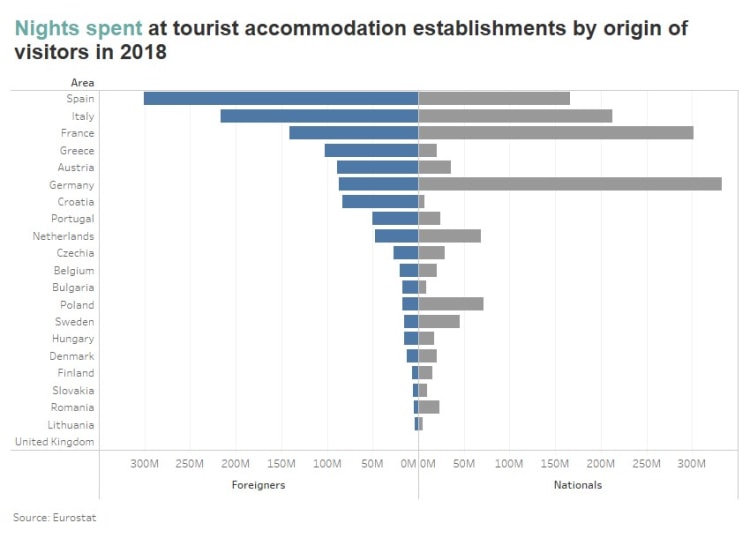

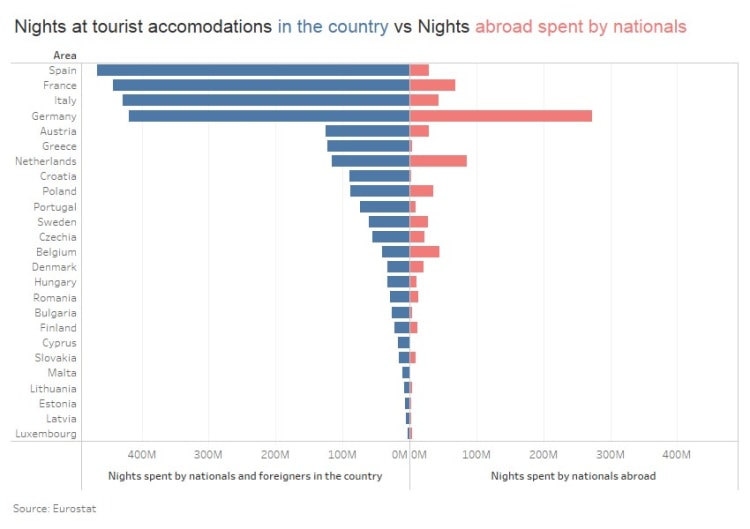

Countries that can expect to see some sizeable demand return as holidays are taken in the home country as opposed to outside their borders include the Netherlands, Germany, Belgium and Denmark. In contrast the countries which usually attract substantial foreign tourism, and will not in 2020 include predictably Spain, Italy, Greece, Portugal, Croatia and Malta. Demand for PET resin in these countries is expected to decline versus 2019.

These demand trends for virgin PET resin impact the R-PET market in terms of supply. Any decline in beverage consumption is a reduction in bottles available for collection. Clearly this analysis shows a displacement of demand greater than reduction, as staycations result in elevated domestic consumption. This suggests that those countries which operate collection systems that typically produce the highest collection rates will increase the volumes collected, such as Germany and those with deposit return schemes.

Overall, this analysis does not suggest growth in consumption at a time when R-PET users are striving towards sustainability pledges and the supply chain needs higher growth in the regions’ recovery rate. In 2018 the recovery rate of PET bottles in Europe was 63% from the ICIS annual study of the R-PET industry, and the expected growth rate over 2020/2021 was around 3% per year. However, ICIS analysis shows that in order to meet the recovery targets of the Single Use Plastics (SUP) Directive the required growth rate in recovery is double this at up to 7% per year. Collection and sorting are not only the first stage of the recycling chain but the most critical. Without the necessary quantity and quality of bales, or feedstock, the supply chain cannot produce the R-PET product required to meet the high level of demand now and in the future.

By Susan Mair, Petrochemical Analyst ICIS

Photo: pl.freepik.com