As the global economy faces mounting downward pressure and factors of uncertainties, the global plastics and rubber industries are at crossroads. The challenges are steering investments to become more conservative as companies adjust their strategies. However, growth outlook remains strong for Asian markets that are not new to economic ups and downs, especially the emerging economies in the region.

Chinaplas 2020 takes a “local + regional + global” approach and provides a platform of highly cost-effective and technologically advanced solutions that fit the needs of new markets for both upstream and downstream players.

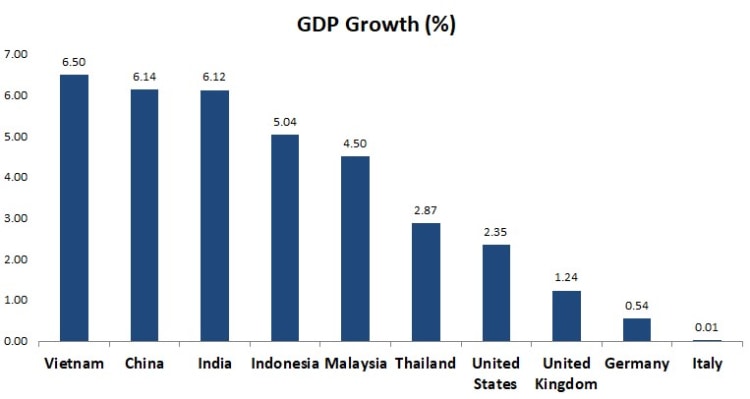

Asia leads the world in economic vitality

Asia has become the largest cluster of emerging economies in the 21st century. This region boasts more than half of the world’s population, expanding middle class, increasing consumption, and continuous industrial transformation. Asia’s fast rise remains attractive despite economic slowdown. Asia currently represents more than a third of the global economy, and its self-reliance continues to strengthen – trade within Asia far exceeds the total of Asia’s trade with other regions such as North America and Eurozone.

Data source: International Monetary Fund (October 2019)

Attracted by the region’s momentum, foreign investment continues to grow in Asia. According to the “Progress of Asian Economic Integration Annual Report 2019” by the BoAo Forum for Asia, investments are retreating from developed economies, especially the capital market in the U.S., and instead going into emerging Asian markets. China’s Ministry of Commerce announced in November 2019 that China is gaining more foreign investment, not less, despite the sluggish global investment scene. During the first three quarters of 2019, China established more than 30,000 new foreign-invested enterprises and utilized 683.2 billion yuan of foreign investment – up 6.5% year over year.

Strong growth in emerging Asian markets

Emerging economies in Asia are continuously introducing new policies to help companies transform and to attract foreign capital. Combining that with their domestic market potential, the manufacturing sector is growing in leaps and bounds. Every year, about 60% of Chinaplas overseas visitors come from Asia. And the number of visitors from Southeast Asia has been growing in recent years.

Vietnam is becoming a rising star in the region. According to the nation’s General Statistics Office, its GDP grew by 6.98% YOY in the first nine months of 2019, the highest rate in the past 9 years. Furthermore, the plastics industry there has averaged annual growth rate of 15-20% in the last decade.

Among Vietnam’s advantages is its demographic dividend that features a large pool of low-cost labor, combined with competitive costs of land, energy, and taxes. In addition, its ports and stable currency have supported the growth of its export-oriented manufacturing sector. Many multinational conglomerates have established footprint in Vietnam, including Nike, Adidas, Olympus, Microsoft, Nokia, Canon, LG, Foxconn, Sony, Samsung and more. Chinese plastics machinery manufacturers, such as Haitian, BORCH, Yizumi and JWELL, have also set up production bases, warehouses, subsidiaries, and after-sales service offices there.

Just like Vietnam, other Asian countries such as Thailand, Malaysia, Indonesia and India are also delivering solid growth, each with strong focuses.

Dubbed as the Detroit of Asia, Thailand has become an automotive capital with 2019 production expected to reach 2.15 million vehicles. Thailand is also known as the World Kitchen, and its packaging industry is expected to grow at a CAGR of 4.2% between 2017 and 2020.

Malaysia is also benefiting from rapid growth of the packaging industry, with more than 1,500 plastics processors in the nation. Malaysia projects its food and beverage industry to reach $268 million in revenue in 2019, sustaining an 18% compound annual growth rate; in the meanwhile, the pharmaceutical industry is also giving a boost to the packaging market.

In Indonesia, the food and beverage market grows 3.7% annually and supports the expansion of the plastics industry. Automotive investment has been active in Indonesia as well. Hyundai is investing in an electric car plant with annual production capacity of 250,000 vehicles. An investment consortium from South Korea, Japan and China is building a $4 billion EV battery plant.

In addition, Thailand, Malaysia and Indonesia – the “Big Three” – have released their respective roadmaps for electric vehicles.

India, home to a population of 1.3 billion, boasts demographic dividend, a massive and fast expanding domestic market, and rapidly growing construction, automotive and chemical industries.