As regards the first quarter of 2023, the forecast based on an Amaplast member survey in early January highlighted the following expectations:

- +7% in orders (with respect to the same period in 2022). The outlook is positive, with sub-stantially similar intensity, for both the Italian and foreign markets

- +6% in turnover, still significantly positive but slightly less stellar than revenues from the pre-vious quarters. Sales abroad should once again be the principal source of satisfaction.

The outlook for the rest of 2023 remains uncertain, given the economic and political context that is still a bit up in the air. While the issue of energy costs and availability of raw materials and compo-nents has shown some partial improvement, troubles continue to be the order of the day - such as the recent bank crisis - and this makes any attempt to forecast the future quite challenging, to say the least.

Focusing on the German competitors, on the basis of the most recent surveys, at the end of 2022 they recorded a thirteen point drop in orders (the domestic market is particularly weak) coupled with a +10% in sales (sales abroad showing the principal positive signs). In this first glimpse of 2023, the gap between orders (-40%, with a collapse in domestic orders) and sales (+21% but here the best performance was observed at home) is only deepening.

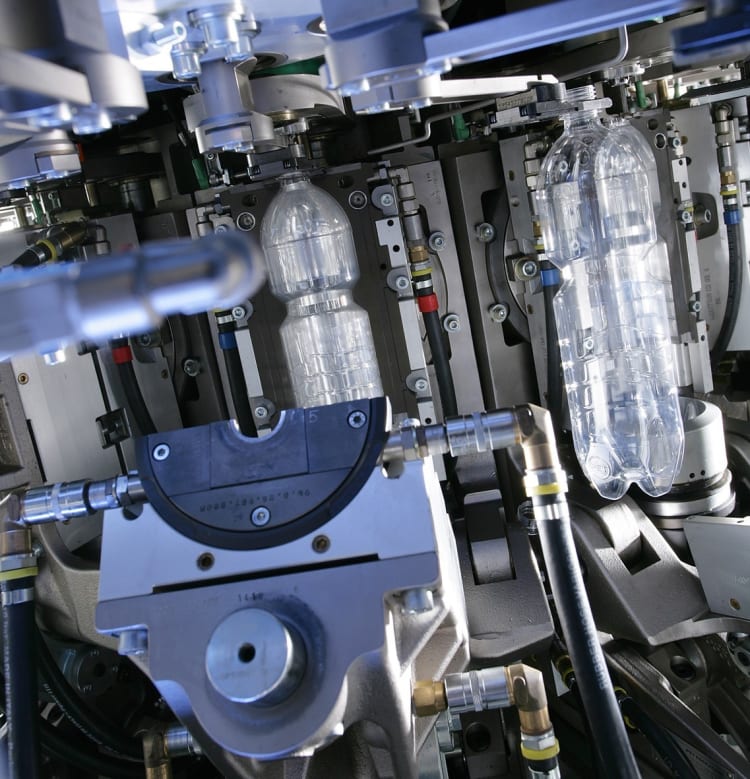

For the Italian segment of the industry, 2023 is above all the year of Plast, one of the world’s premier fairs for the plastics and rubber industry organized by Promaplast srl. After a five-year hia-tus, the fair will open its doors again on 5-8 September 2023 at the Fiera Milano Rho fairgrounds. Companies are getting ready to show the world the best of the Made-in-Italy in terms of design, ma-terials, sustainability, and smart technology.

Source: www.amaplast.org